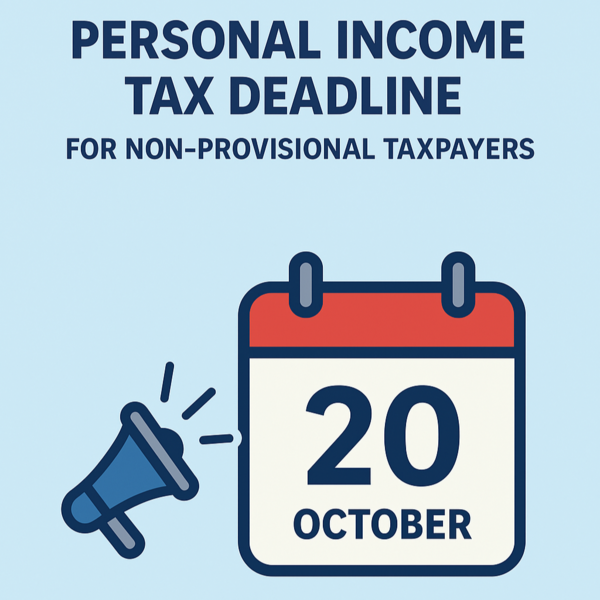

When Is My Tax Return Due? 2025 Deadlines for Non-Provisional Taxpayers

9 Oct 2025

🧭 Who’s Affected?

- Non-provisional taxpayers: You earn income from a single source (like a salary), and you don’t submit IRP6 forms.

- Not auto-assessed: If SARS didn’t pre-fill your return, you need to file it yourself.

- IRP5/IT3(a) from your employer

- Proof of deductions (medical aid, retirement annuity, etc.)

- Updated banking and contact details

- A few minutes of diagnostic calm

⚠️ Why It Matters